Customer Acquisition and Retention

| Overview | Solution | VALUE TO YOU | next steps |

Offering insurer’s the ability to provide differentiated value to their customers and prospects.

Improve customer acquisition

| 50% of insurance executives believe improved customer acquisition will be their primary growth driver in the next three years. Accenture |

| 90% of insurance CEOs rank “getting closer to customers” at the top of the agenda. Accenture |

| Customer acquisition and retention depend heavily on the insurer’s ability to deliver customized experiences to different customer segments. Accenture |

Improve customer retention

| Consumers are receptive to targeted cross-sell offers if the value proposition is clear and the process is easy. Ernst & Young |

| Consumers want to remain loyal and buy more from the same product provider. Ernst & Young |

| Customer experience will be critical for insurers to retain and sell more and different products to customers. Ernst & Young |

Optimize the distribution channel

| The cost of face-to-face advice is out of line with industry revenues and growth due to poor customer segmentation and targeting plus operational inefficiencies. Deloitte |

| Existing distribution capabilities prevent many carriers from providing a differentiated customer experience. Accenture |

| Insurers want to develop multi-channel distribution models that are more versatile, integrated and flexible. Accenture |

Gaining deeper insights into customers, agents, markets, channels and marketing

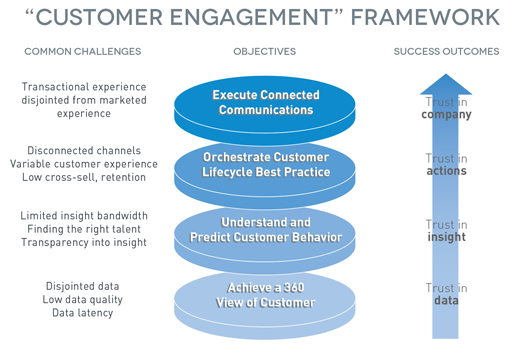

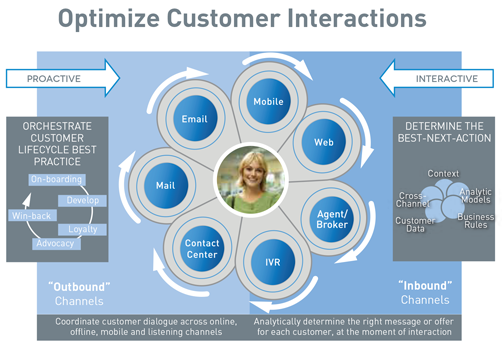

The customer experience will be a critical element of insurers’ efforts to retain and sell more and different products to their customers in the coming years. With a widening array of channels and technology, optimizing the customer experience continues to be increasingly difficult and complex. The key is providing insurers with the ability to deliver customized experiences to their different customer segments.

By deploying the right products and agents against their most promising opportunities, insurers can separate themselves from the competition and achieve sustainable growth. Most importantly, they will gain the ability to provide differentiated value to their customers and prospects.

Leverage customer insight and predictive modeling for greater customer engagement

The Pitney Bowes Software solution enables you to consolidate and integrate customer account and interaction information, leverage that data for identifying past trends and predict future actions. It allows insurance companies to:

- Gain critical insight into their existing customers.

- Provide models for target segmentation and value messaging for acquiring new prospects.

- Leverage customer insight and predictive modeling for greater retention and driving improved up-sell/cross-sell campaigns.

- Increase customer service/interaction between agents, call centers and policyholders.

Dramatically improve customer retention and

acquisition rates

The Pitney Bowes Solution offers a host of benefits:

- Improve targeted marketing campaigns to get the best value for marketing dollars invested.

- Improve customer retention rates by 15-30% through predictive modeling and identifying the next BEST action.

- Improve acquisition rates by 10-30% through improved target segmentation and predictive modeling.

- Drive increased retention rates by giving agents/call centers the best tools for real-time decisioning with customers.

- Faster implementation and minimal integration allows organizations to realize benefits.

The Pitney Bowes Software solution enables you to consolidate and integrate customer account and interaction information, leverage that data for identifying past trends and predict future actions. This insight helps drive product development and outbound marketing efforts for client acquisition, as well as optimize agent and call center interaction to retain customers or move them to the desired best next product. The solution allows companies to realize higher response rates for outbound campaigns, as well as lowered costs through better analysis. Key Recommendations:

- Leverage customer insight and predictive modeling for greater retention and driving improved up-sell/cross-sell campaigns.

- Develop models for target segmentation and value messaging for acquiring new prospects

- Introduce campaign management tools to drive better campaigns by leveraging customer analytics over multiple channels.

| Connect With Your Customers Harnessing Data Insights to Revolutionize Customer Acquisition and Retention Discover how insurers gain insights into prospects and customers to help them better determine the ideal customer mix, target the right individuals and groups, and develop products and allocate marketing resources to reach those audiences. Learn more |